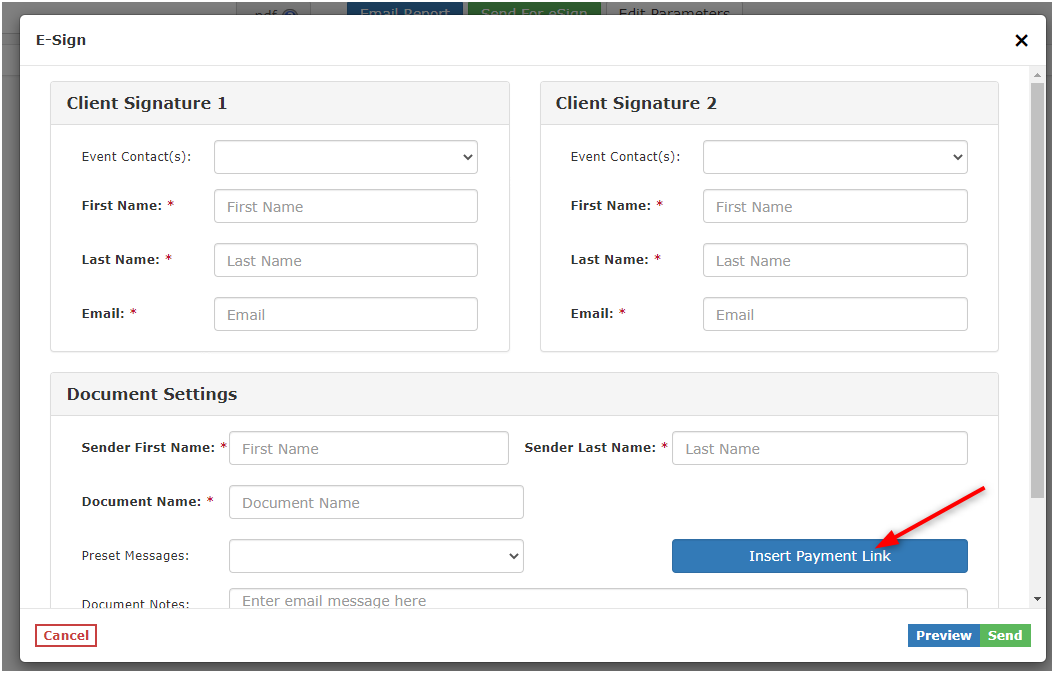

Insert Payment Links in eSign

No more sending two emails! We have added the ability to insert Payment Links in your eSign emails.

Note: This feature requires an integrated credit card processor and our eSign feature.

This will allow you to send your Contracts and/or Proposals for digital signature while also including a link for your clients to make a payment!

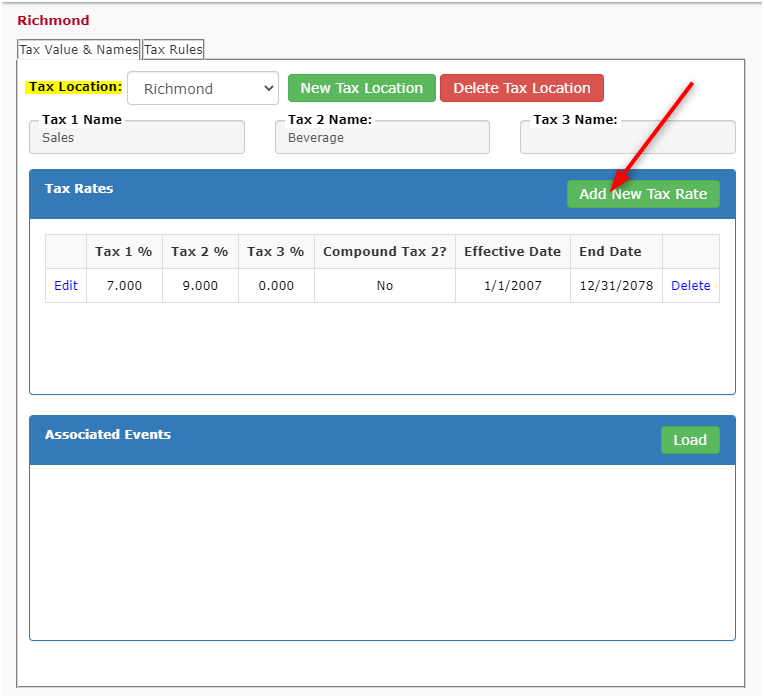

Updates to Taxing Rules

We’ve disabled the ability to edit existing Tax Rates and Effective Dates.

This was done in order to prevent changes to past events from users accidentally changing the taxes on all their events using the previous method.

To update your Tax Rates, select the Tax Location you wish to modify from the Tax Location Drop Down Menu, then click Add New Tax Rate.

If you make a mistake during this process, simply click Delete next to the incorrect date range and then start over with the new update.

As always, we encourage you to contact our Client Care team with any questions or for more information on updating Taxes in TPP!