Getting Started Guide

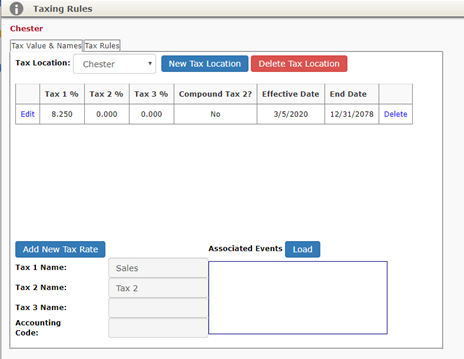

Taxing Rules

- From the upper right-hand corner menu bar, select the Profile Menu | Administration | Taxing Rules.

- The Tax Value & Names tab is active.

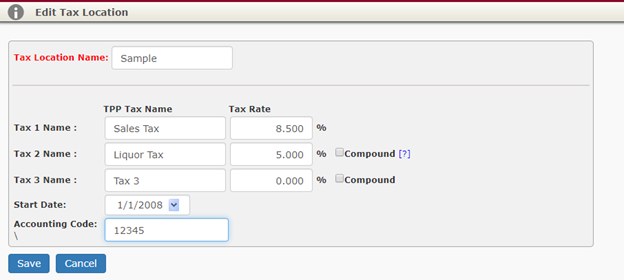

- Click the New Tax Location button.

- Type in a Tax Location Name you would like to identify your tax with (typically this would be a county or locality name).

- Type in the appropriate tax rate for Tax 1.

- If you have more than 1 tax rate to charge items to, enter those values for Tax 2 and Tax 3.

- Leave the default Start Date.

- This date should always be sometime in the PAST to accommodate any earlier event bookings you may want to enter.

- Click the Save button. The entered data is displayed.

- Click the Tax Rules tab.

- Simply stated, your events will follow the taxation rules listed in the grid.

- For example, by default your food (menu) will tax at the rate setup under Tax 1.

- Other tax rules apply to beverages, rentals, staff, and service charges.

- Click the Edit hyperlink.

- Leave the default Effective Date.

- This date should always be sometime in the PAST to accommodate any earlier event bookings you may want to enter.

- Update the appropriate tax rates from each drop-down list for menu, beverage, rentals, staff, and service charge.

- You may also define SECOND tax options.

- Click the Save button.

- You may setup multiple Tax Locations to use if your tax changes depending on where your events are taking place.